by Marcin Zarzecki, CEO of Quotiss

There are many good things one can say about container shipping and its global impact on the world economy. But shipping lines are also very well known for sending very complex and unstructured freight ratesheets. During my time in Maersk, where I spent over 10 years in the sales function, I was often struggling with the challenges of the pricing and quoting policies, despite Maersk being one of the most advanced carriers and the global leader in this aspect.

One of the reasons why I started Quotiss 2 years ago was to simplify ocean tariff management. By this time, we have collected a lot of data.

By now, I have seen thousands of freight ratesheets from various shipping lines, and I had time to analyze their structure very thoroughly. Conclusions are surprising and not too cheerful: this tremendous complexity comes from the internal inefficiencies and ‘broken’ processes of the shipping lines themselves.

The Data

The analysis is based on the data collected from the ocean tariffs that are uploaded into the Quotiss software by freight forwarders. The data has a healthy mix of various parameters:

– Freight forwarders who use Quotiss software work with most of the major shipping lines – we studied the specific rate formats of all major ocean carriers;

– Freight forwarders who use Quotiss software come from different parts of the world – we studied the differences in the rate format based on the specific country/office which prepared the rate sheet;

– Freight forwarders who use Quotiss software work with shippers in different industries – we studied the differences in the NAC / special freight rates/exceptions format.

The Analysis

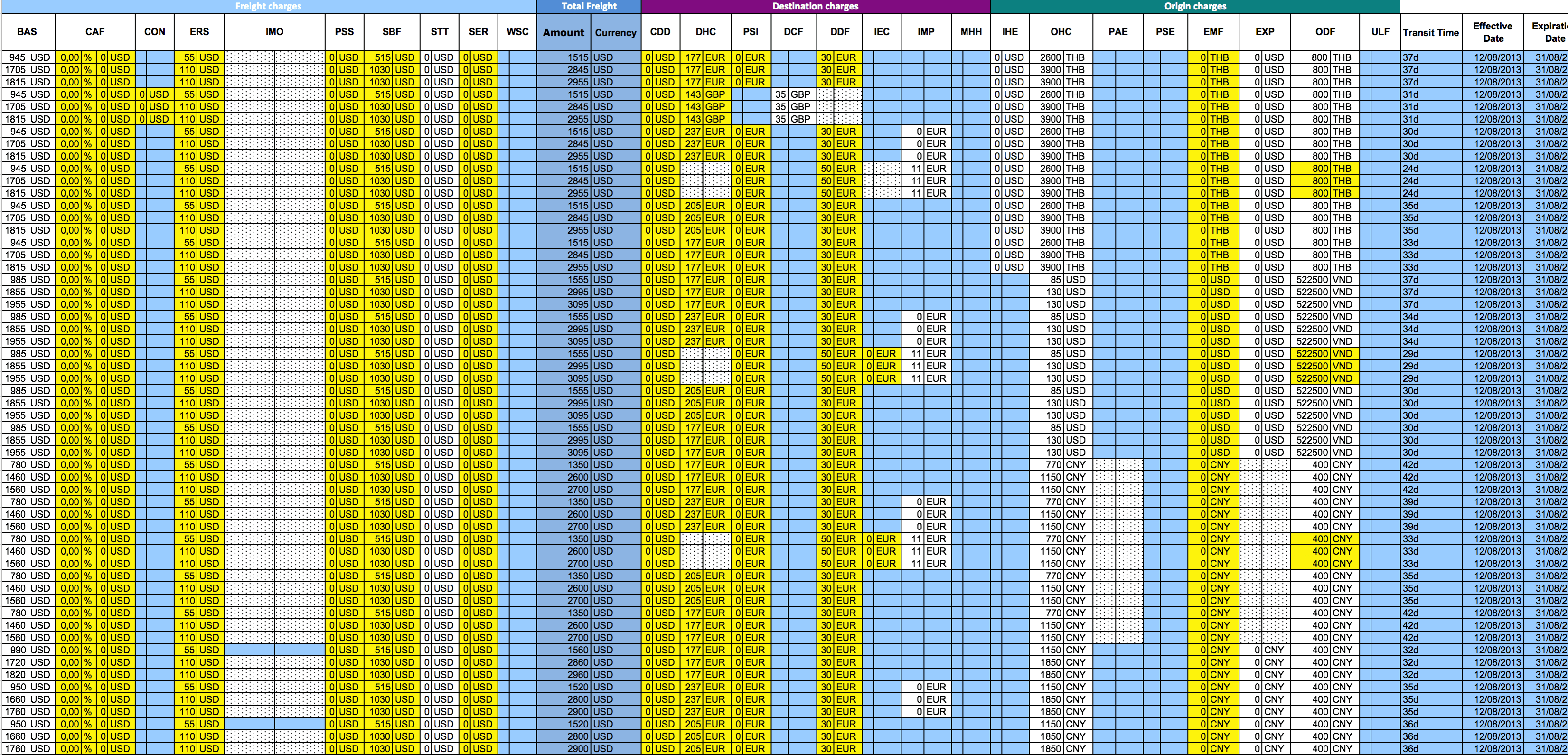

Let’s look at Far East Asia – Europe ratesheet generated by one of the major shipping lines.

1. The structure

This rate sheet contains 15 000 port pairs, 109 000 lines with rates and surcharges, 545 000 unique rates for all equipment types. It is 500 000+ unique rates in a single freight ratesheet for just one trade/direction, with the validity of 2 weeks maximum.

2. The delivery method

This freight ratesheet has been emailed to a freight forwarder as Excel file in attachment. Freight rates on the Asia-Europe corridor change very often, sometimes even a couple of times per week. Let’s assume, the average update frequency is weekly. This means, that every week, a bulk load of freight ratesheets with half a million rates each is generated and sent by email to hundreds of freight forwarders globally.

That is 500 MILLION unique freight rates that are being updated and distributed on the market, all by just one shipping line on one trade/direction.

3. Local specifics

Everyone in the industry knows that different shipping lines send their freight ratesheets in different formats, like .xls, .pdf, or just copy-paste Excel table to the email body. But only a few people know that even within the same shipping line, different offices might use different templates and formats. Sometimes, even within the same office, salespeople send freight rates in different formats.

These format discrepancies within one company usually come from the big list of exceptions that are specific to the country/port.

There is a clear lack of the unified standard across the ocean carriers, which comes from the lack of standard software solutions that would be capable to cater for the giant list of local exceptions in an automated way.

The Conclusion

The saddest part is that over 99% of contents inside these freight ratesheets will never be used by anyone. Statistically, almost all cargo traffic on Far East Asia – Europe trade lane is generated by 20% of ports. Pareto Rule works for all trades in ocean shipping.

There is a lot of waste in the process. Shipping lines realize this waste and work hard to improve the quoting process by trial and error, implementing various custom-made software solutions. But improving the ‘spreadsheeting’ is like putting lipstick on the pig – doesn’t make it any more pretty.

The Solution

Is there any solution to bulky freight ratesheets? There is an obvious and logical one: for the real change to happen in container shipping, ocean carriers have to simplify and unify their pricing structure across all offices/trades.

Once the pricing is simplified, the quoting can be dramatically improved, as we do it in Quotiss. In my next post, I will dig deeper into the most common errors which we see in the freight ratesheets.